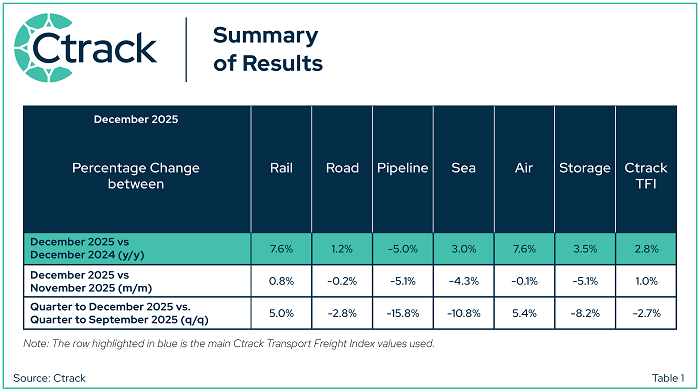

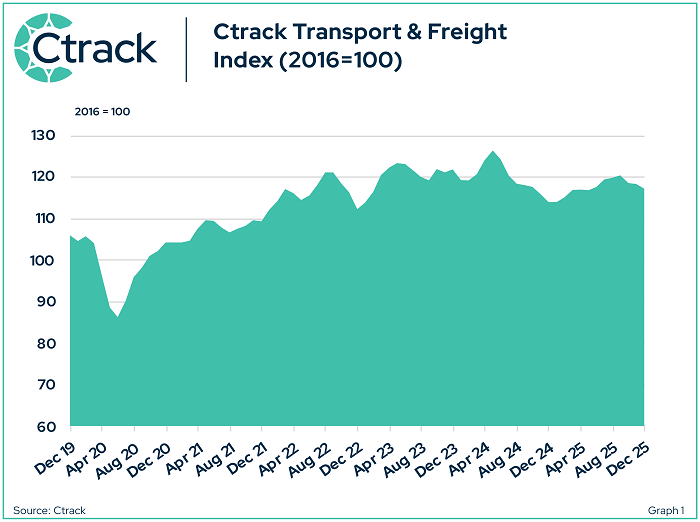

After having increased in seven of the nine months to September 2025, the Ctrack Transport and Freight Index (Ctrack TFI) lost momentum in Q4 and ended the year at an index level of 117.1, still 2.8% higher than a year earlier. The weakness in the sector towards the end of the year turned out to be quite widespread, with quarterly contractions recorded for all sectors, but rail and air freight.

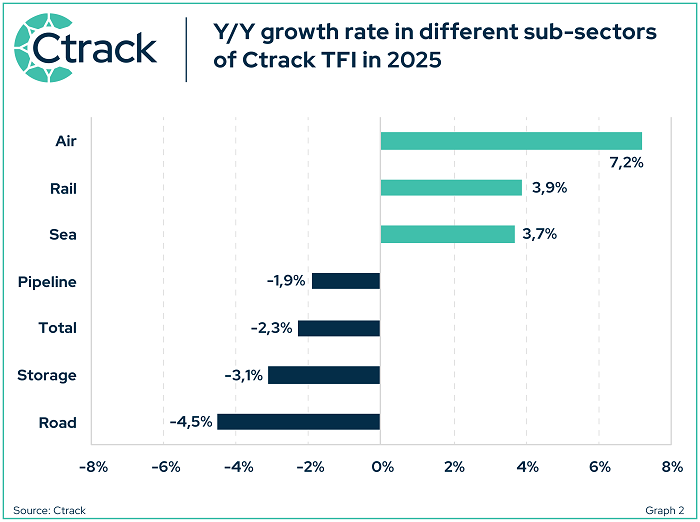

Considering the year 2025, it is evident that the sub-sectors that were under pressure in 2024, remained in the doldrums in 2025 (road freight, pipeline flows and storage sector), while the sub-sectors that moved into recovery mode in 2024, built on progress and momentum and clocked another good growth year in 2025 (rail, air and sea freight). The fragmented nature of the logistics sector keeps a lid on the sector’s overall performance in 2025, with the Ctrack TFI contracting for a second consecutive year.

GRAPH1: CTRACK TRANSPORT & FREIGHT INDEX (2016=100)

GRAPH1: CTRACK TRANSPORT & FREIGHT INDEX (2016=100)

Considering calendar 2025, three sub-sectors contracted compared to a year earlier and three sectors advanced. However, given that the heavy-weighted road freight sub-sector remained under pressure, the overall logistics sector lagged by 1.9% compared to 2024, the second consecutive annual contraction (2024: -0.5%). Road freight (-4.5%), transport via pipelines (-3.1%) and the sub-component for storage and handling (-2.3%) contracted, while the air freight (7.2%), rail freight (3.7%) and sea freight (3.9%) sub-sectors recorded growth - see graph 2.

Notable progress on structural reforms to improve operational efficiencies and modernise the freight logistics sector has been observed during 2025 and are creating a base to support future growth in the industry and the economy at large. Much-needed efficiency gains at ports and the rejuvenation of the rail network, will in due course (slowly but surely) impact the economy positively by reducing transport costs, while enabling robust export growth potential. While acknowledging that it remains still early days with enormous potential for improvement, both the rail freight and sea freight sub-sectors (where the bulk of structural reforms are concentrated) performed reasonably well in 2025.

GRAPH 2: Y/Y growth rate in different sub-sectors of Ctrack TFI in 2025

GRAPH 2: Y/Y growth rate in different sub-sectors of Ctrack TFI in 2025

Winners in 2025

The Air Freight sector has again been the star performer among the sub-sectors in 2025, aligning with global trends. Following an increase of 11.3% in Global Cargo Tonne-Kilometres (CTK) in 2024, the International Air Transport Association (IATA) reported a further increase of 3.3% in international air freight demand in 2025 (year-to-Nov), underscoring continued resilience. African carriers also performed well, driven by e-commerce growth and strong intra-regional trade flows. The air freight index increased by 7.2% in 2025 (2024: 10.5%), with three of the four underlying components of the index rising strongly. Cargo load on planes increased by a notable 10.3% in 2025, compared to the previous year’s increase of 21.9%. While more costly, air freight often plays an important role in filling the gaps when other transport modalities like sea freight are under pressure.

On Sea Freight, consolidated port throughput in 2025 showed encouraging signs of recovery. Container throughput in (all ports in SA) totalled 4,473 million TEUs in 2025, up by 3.2% compared to 2024. Total bulk cargo handled in 2025 totalled 221 million tonnes, up by 4.4% compared to 2024, while vehicle throughput in 2025 totalled 899 094 units, up by a notable 15.0% on 2024. Furthermore, after a lengthy legal spat, the Durban High Court has dismissed an application by a losing bidder to halt the implementation of a partnership for the Durban Pier 2 Container Terminal (DCT). This has opened the door for the DCT to transition to a new operating model involving International Container Terminal Services Inc. (ICTSI), with formal management having transitioned to the new entity effective 1 January 2026. It is envisaged that the introduction of private sector participation to South Africa’s largest container terminal has the potential to unlock new investment and management expertise to meaningfully improve operational performance.

The Sea Freight sub-component increased by 3.9% in 2025 following on growth of 3.4% in 2024. While reform progress has generally been slow and implementation challenges persist, the National Treasury has renewed its fiscal commitment to support Transnet’s recovery plan and early signs of improvement are indeed welcomed. The commitment to expand private sector participation in port operations are pivotal in revitalising South Africa’s trade-enabling infrastructure and improve logistics performance over the medium term.

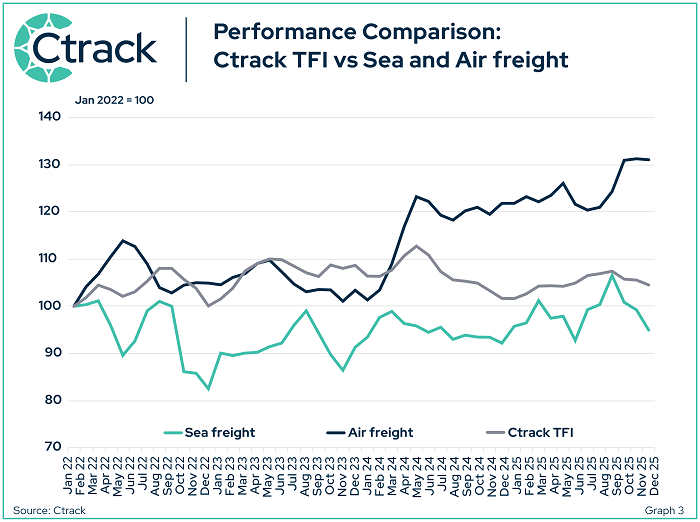

While 2025 as a whole was a better year for sea freight, the sector ended 2025 on the back foot, with the index declining by 10.8% in Q4 compared to Q3. Transnet Port Terminals indicated 30 export days were lost at the Port of Cape Town due to extremely windy conditions, impacting negatively on seasonal fruit exports – see graph 3.

GRAPH 3: PERFORMANCE COMPARISON: CTRACK TFI VS SEA AND AIR FREIGHT

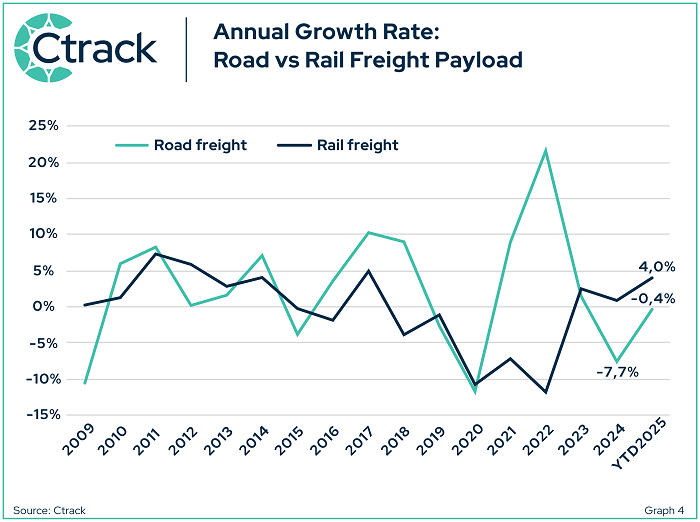

The recovery in the Rail Freight sector gained momentum in 2025, with the sub-component of the Ctrack TFI increasing by 3.7% in 2025 vs 4.0% in 2024. The impact of reforms aimed at restoring and growing rail capacity in South Africa, are slowly but surely, starting to impact positively on the sector’s performance. Rail freight payload in South Africa increased by 4.0% (year-to-Oct) compared to increases of 0.8% and 2.5% in 2024 and 2023, respectively. While still hesitant, rail freight payload has increased for three consecutive years, though still lagging notably on previous years’ performances. From reaching a rock-bottom low of only 9.0% of total freight payload been transport via rail in November 2022, the performance of rail has improved to 15.2% in October 2025 (full year 2024: 14.1%), though still notably lower than the 10-year average of 22% (rail freight to total payload in 2008-2017) prior to the onset of the significant deterioration. The rail freight sector remains a top priority in government’s structural reform initiatives, as outlined in the Freight Logistics Roadmap. The reforms aim at restoring and growing rail capacity in South Africa, to ultimately reduce trucks on the roads in the medium term and to reset to a more sustainable road/rail freight balance. However, the task at hand is enormous and it will take some years before a notable trend reversal will be evident – see graph 4.

GRAPH 4: ANNUAL GROWTH RATE: ROAD VS RAIL FREIGHT PAYLOAD

GRAPH 4: ANNUAL GROWTH RATE: ROAD VS RAIL FREIGHT PAYLOAD

Losers in 2025

The road freight sector accounted for 85.4% of all freight payload in South Africa in the first ten months of 2025, and as such it remains a critically important sub-sector in the logistics space. The road freight sector had another difficult year in 2025, dealing with many ongoing challenges, impacting negatively on the sector’s performance. The impact of exponential growth in the industry in 2021 and 2022 (responding to the demise of rail freight at the time), later led to an over-supply of heavy trucks, declining margins and market consolidation. In addition, government’s efforts to move cargoes back to rail have started to impact the sector negatively, though only to a marginal extent in 2025, with the impact expected to be more notable in the medium term. Still, the cumulative impact of the headwinds experienced in recent years resulted in road freight payload declining by 7.7% in 2024 and further by 0.4% in the first ten months of 2025 – see graph 4.

While still a grim picture, some green shoots have started to appear. Heavy vehicle traffic on the N3 route (large and extra-large trucks) ended the year with a notable increase of 8.3% y/y in Q4, and a full-year increase of 5.0% for 2025 (vs -1.0% in 2024), partly reflecting the improved operational performance of the Durban port and a welcome uptick in economic activity towards the end of 2025. On the contrary, heavy vehicle traffic on the N4 route plummeted by around 17% in 2025, a second consecutive year of contraction as some normalisation plays out after notable increases were recorded in 2022 and 2023. At that time, troubles at the Port of Durban resulted in cargo loads been redirected towards the Port of Maputo, resulting in heavy vehicle traffic on the N4 route skyrocketing with growth rates of around 57% and 25% in 2022 and 2023, respectively. Thus, the pullback on the N4 route is off an extremely high base.

The logistics sector remains in the midst of a period of transformation. From a percentage of 78.3% in 2010, road freight as a percentage of total freight gradually moved higher to reach an all-time high of 91.0% late in 2022. The latest available data suggests that road freight as a percentage of total freight payload was 84.8% in October 2025, compared to 85.9% in 2024 (full year). While there are plans on the table to move cargoes back from road to rail, many obstacles are still in the way and it will likely take a considerable period and noteworthy effort to address all the challenges, clearly a very gradual medium to longer term process.

A sub-sector that has remained under pressure for the past few years is the transport of liquid fuels via Transnet Pipelines (TPL). The sector declined by 3.1% in 2025 (following on declines of 1.8% and 0.9% in 2024 and 2023, respectively). A multi-year trend of declining fuel consumption explains the pressures observed in this sub-sector. According to the Department of Minerals and Energy, petrol and diesel consumption in South Africa has declined by 5.8 billion litres since 2015, shedding billions of rand in lost revenue and putting pressure on the country’s more than 4 600 garage forecourts to stay afloat. The plunge in consumption was worsened by the outbreak of Covid-19 in 2020, which saw companies adopt hybrid work models. Data from the energy department showed that petrol consumption, which peaked at 12 billion litres in 2015, plunged to 8.7 billion by 2024, while diesel consumption declined from 14 billion litres to 11.8 billion, with the latter somewhat shielded by Eskom purchases. While people are these days going back to the office again, this is still not at the same levels compared to 2019 (pre-Covid).

The Storage and Handling sub-sector of the Ctrack Transport and Freight Index declined by 2.3% in 2025, the fourth consecutive year of contraction. Inventory indicators have been trending lower in recent years, partly due to sluggish local demand levels, but also probably a structural decline due to improved efficiencies and the impact of technology on warehousing and inventory management.

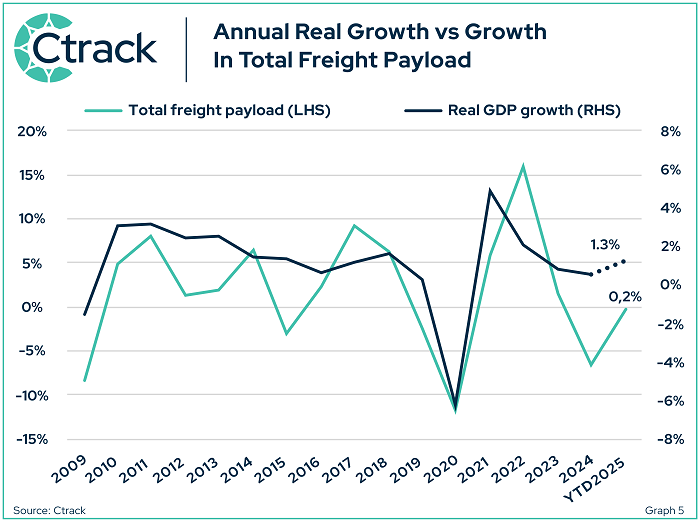

The CTrack TFI signals the transport sector’s continuing under-performance relative to the overall economy in 2025

Historically, the transport sector’s performance was well-correlated with overall economic growth. In the past two years, however, the transport sector underperformed compared to total economic growth – see graph 5. Transport & communication sector growth is forecast at 0.8% in 2025 (vs -1.2% in 2024) vs overall GDP growth forecast at 1.3% for 2025 (vs 0.5% in 2024). An improved economic outlook, in combination with ongoing structural reforms in the sector, should provide some additional stimulus to the transport and logistics sector in 2026.

GRAPH 5: ANNUAL REAL GROWTH VS GROWTH IN TOTAL FREIGHT PAYLOAD

GRAPH 5: ANNUAL REAL GROWTH VS GROWTH IN TOTAL FREIGHT PAYLOAD

“While the sub-par performance of the logistics sector in 2025 remains disappointing, ongoing progress on structural reforms to improve operational efficiencies and modernise the freight logistics sector has been observed during 2025 and should create a base to support future growth in the industry and the economy at large,” says Hein Jordt, Chief Executive Officer of Ctrack.

Summary of results: